annual gift tax exclusion 2022 irs

Gift tax rules for 2022 onwards Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient. The gift tax limit for individual filers.

The Sound Of Music Photo Maria At The Convent Sound Of Music Movie Sound Of Music Music Photo

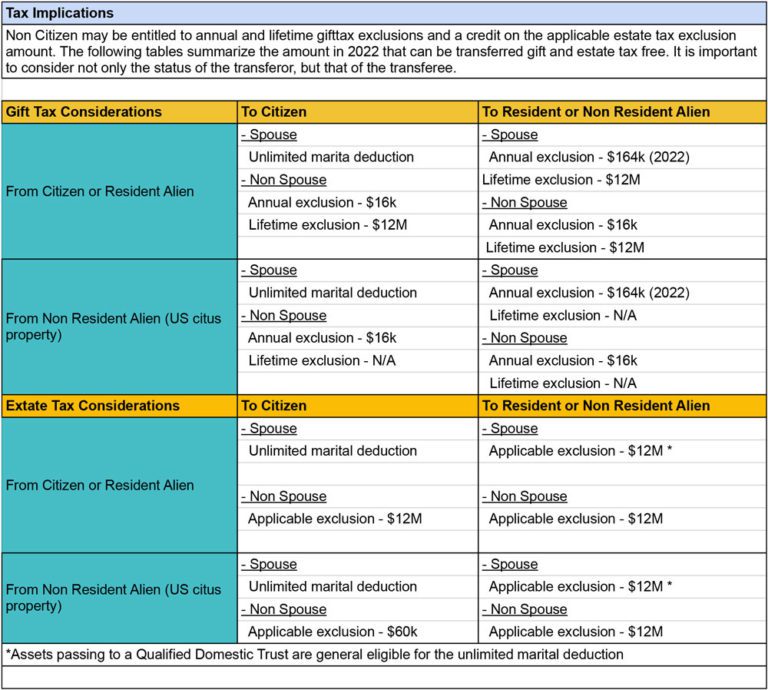

Any person who gives away more than 16000 to any one person is technically required to file Form 709 the gift tax return.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. Any person who gives away more than 16000 to any one person is required to file Form 709 the gift tax return. What if my spouse and I want to give away property that we own together. For 2022 the lifetime exclusion is 1206 million.

If you regularly make annual exclusion gifts to children or grandchildren or contribute to trusts or college savings plans for their benefit consider increasing the amounts. For the past four years the annual gift tax exclusion or the amount of money or assets youre able to transfer to another person without incurring a gift tax has been 15000. Annual Gift Tax and Estate Tax Exclusions in 2022 Jayde Law PLLC The amount you can gift to any one person without filing a gift tax form has to 16000 for 2022 the first increase since 2018.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS. Like weve mentioned before the annual exclusion limit the cap on tax-free gifts is a whopping 16000 per person per year for 2022 its 15000 for gifts made in 2021 2. Annual Gift Tax Exclusion.

What is the annual gift tax exclusion for 2022. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS. When giving gifts worth more than the annual exclusion.

Annual Gift Exclusion. ANNUAL GIFT TAX EXCLUSION Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of. 2022 Annual Gift Exclusion.

Increased annual gift tax exclusion for 2022 For the first time in several years the IRS has raised the annual gift tax exclusion from 15000 to 16000 per recipient effective January 1 2022. So even if you do give outrageously you wouldnt have to file a gift tax return unless you went over those limits. The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to 14890 up from 14440 for 2021.

However the IRS just announced an increase to a new high exclusion amount of 16000 per recipient. In 2018 2019 2020 and 2021 the annual exclusion is 15000. The IRS also increased the annual.

Any person who gives away. For example a man could give 16000 to each of. In 2022 the annual exclusion is 16000.

When your gift-giving crosses your lifetime exclusion. In most cases the IRS doesnt care about gifts except. In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a person can give up 16000 to as many people as they want without having to pay any taxes on the gifts.

The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. For example assume that in 2022 you give gifts totaling 16000 to each your three children for a total of 48000.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS. The federal estate tax exclusion. Itll also limit the donor to 20000 annual exclusion gifts in total.

The IRS allows individuals to give away a specific amount of assets or property each year tax-free. For the past four years the annual gift exclusion has been 15000. For 2022 the annual gift exclusion is being increased to 16000.

News Release IR-2021-216 IRS announces 401 k limit increases to 20500. The federal estate tax exclusion is also climbing to more than 12 million per individual. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS.

The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018. For 2018 2019 2020 and 2021 the annual exclusion is 15000. Annual Gift Tax Exclusion to Rise to 16000 in 2022 Boosting ABLE Cap The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022.

For 2022 the annual exclusion is 16000. For 2022 the annual gift exclusion is 16000. Any person who gives away more than 16000 to any one person is required to file Form 709 the.

The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021. You are each entitled to the annual exclusion amount on the gift. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or her lifetime gift and estate tax exemption in 2022 1206 million.

The annual gift exclusion is applied to each donee. The Annual Gift Tax Exclusion for Tax Year 2022.

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Advanced American Tax

Taxes 2022 7 On Your Side United Way Answer Viewer Questions During Tax Chat Abc7 San Francisco

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Nonresident Alien Income Tax Return Expat Tax Professionals

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Portugal Tax Important Dates Your 2021 Tax Calendar My Guide Algarve

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Advanced American Tax

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Advanced American Tax

What Is The Bonus Tax Rate For 2022 Hourly Inc

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Historical Look At Estate And Gift Tax Rates Wolters Kluwer

Gift Tax What Is It How Does It Work Personal Capital

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Annual Life Time Gift Tax Exemption Simplified Internal Revenue Code Simplified

2022 Tax Inflation Adjustments Released By Irs

Us Gift Tax Limits And Form 709 For Expats Bright Tax

What Happened To The Expected Year End Estate Tax Changes

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset